SBA Form 4 (Schedule A) 2009-2024 free printable template

Show details

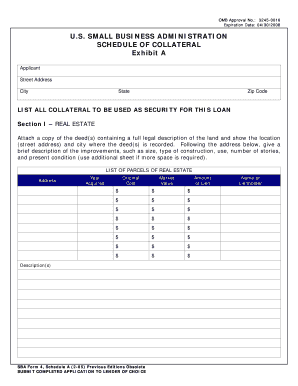

OMB Approval No. 3245-0016 Expiration Date 11/30/2012 U.S. SMALL BUSINESS ADMINISTRATION SCHEDULE OF COLLATERAL Exhibit A Applicant Street Address City State Zip Code LIST ALL COLLATERAL TO BE USED AS SECURITY FOR THIS LOAN Section I REAL ESTATE Attach a copy of the deed s containing a full legal description of the land and show the location street address and city where the deed s is recorded. Following the address below give a brief descriptio...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sba form 4 2009-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 4 2009-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba form 4 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to fill us small business administration schedule of collateral form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

SBA Form 4 (Schedule A) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sba form 4 2009-2024

How to fill out sba form 4:

01

Gather all necessary information and documents, such as your personal identification information, business information, financial statements, and tax returns.

02

Carefully read the instructions provided with the form to understand the requirements and ensure accurate completion.

03

Start by filling out the top section of the form, including your name, business name, and contact information.

04

Provide details about your business, such as the year it was established, its legal structure, and any affiliations.

05

Indicate your business's ownership, including information about the owners or shareholders.

06

Fill out the financial disclosure section, providing information about your business's revenue, assets, and liabilities.

07

Complete the certification section by signing and dating the form.

08

Review the completed form for any errors or missing information before submitting it.

Who needs sba form 4:

01

Small business owners who are applying for a loan or seeking assistance from the Small Business Administration (SBA) may need to fill out form 4.

02

The form is typically required for various SBA loan programs, including the 7(a) Loan Program and the Small Business Development Center (SBDC) Program.

03

Individuals or businesses seeking SBA support or resources may also be required to submit form 4 as part of the application process.

04

It is important to check the specific requirements of the loan or program you are applying for to determine if form 4 is necessary.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sba form 4?

SBA Form 4 is an application form used by small businesses to apply for a loan under the Small Business Administration (SBA) 7(a) Loan Program. The form gathers information about the business, its owners, and its financial history to determine eligibility for the loan program. It includes sections for personal information, business information, purpose of the loan, financial statements, and details about collateral and existing debts. The completed form is typically submitted to an SBA-approved lender.

Who is required to file sba form 4?

The SBA Form 4, also known as the Application for Business Loan, is typically completed by small business owners who are seeking a loan from the U.S. Small Business Administration (SBA). Therefore, individuals or entities that are applying for a business loan through the SBA are required to file the SBA Form 4.

How to fill out sba form 4?

To properly fill out SBA Form 4, also known as the Application for Business Loan, you need to follow these steps:

1. Download the form: Visit the U.S. Small Business Administration (SBA) website and locate Form 4 in the loans section. Download and save the form to your device.

2. Provide general information: In section 1, enter general information about your business, including its legal name, business address, business phone number, and the name of the person completing the form.

3. Indicate loan request: In section 2, specify the type of loan you are requesting by checking the appropriate box. Provide additional loan details such as the desired loan amount, loan term, and intended use of funds.

4. Provide business characteristics: In section 3, provide detailed information about your business, such as its organization type, federal tax identification number, date of establishment, business activity, and the number of employees.

5. Provide ownership information: In section 4, provide information on the business's owners. Include their names, titles, ownership percentages, social security numbers, addresses, and contact information. If there are more than two owners, attach an additional form.

6. Complete financial information: In section 5, provide financial information about your business. Include the most recent three years' tax return information, as well as current financial statements.

7. Provide project information: In section 6, provide information about the project for which you are seeking the loan, including a description and feasibility analysis.

8. Disclose affiliated businesses: In section 7, disclose any affiliated businesses and provide explanations if necessary.

9. Answer eligibility questions: In section 8, answer a series of questions to determine your eligibility for assistance.

10. Provide additional required information: In section 9, provide any additional required information, such as collateral details or other funding sources.

11. Sign and date the form: The person completing the form must sign and date it in section 10.

12. Attach required documentation: Ensure you attach all relevant and required documents, such as tax returns, financial statements, and any applicable supporting information.

13. Review and submit: Review the completed form and attached documents for accuracy and completeness. Make copies for your records, and submit the form as per the instructions provided by the SBA.

It is recommended to consult with an SBA representative or a financial advisor if you have any difficulties or specific questions while filling out SBA Form 4.

What information must be reported on sba form 4?

SBA Form 4, also known as the Borrower Information Form, is required to be completed by borrowers seeking financial assistance through the U.S. Small Business Administration (SBA). The information to be reported on this form includes:

1. Basic information: This includes the borrower's legal name, DBA (doing business as) name, and address.

2. Business information: Details about the business, such as its legal structure (e.g., sole proprietorship, partnership, corporation), industry code, and purpose of the loan.

3. Ownership information: Information about the ownership structure of the business, including the names, addresses, Social Security numbers, and ownership percentages of all owners with at least a 20% equity interest.

4. Criminal history: Disclosure of any criminal history of the borrower's owners or key employees, including convictions, guilty pleas, or ongoing criminal proceedings.

5. Business certifications: As applicable, the form requires disclosure of the borrower's certifications, such as being a veteran-owned small business or disadvantaged business enterprise.

6. Loan information: Details regarding the loan request, such as the requested loan amount, anticipated use of funds, and whether the borrower has received any previous SBA disaster loans.

7. Contact information: The form requires providing names, titles, phone numbers, and email addresses for key individuals within the business to facilitate communication with the SBA.

These are some of the key pieces of information that must be reported on SBA Form 4. It is important to note that borrowers may have to provide additional documentation and information depending on their specific circumstances and loan program. It is recommended to consult with the specific SBA program guidelines and instructions for the most accurate and up-to-date information.

What is the penalty for the late filing of sba form 4?

There is no specific penalty mentioned for the late filing of SBA Form 4 in the available information. It is advisable to contact the Small Business Administration (SBA) directly or consult the latest guidelines provided by the SBA to obtain accurate and up-to-date information regarding any penalties or consequences associated with late filing.

How can I manage my sba form 4 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your how to fill us small business administration schedule of collateral form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in sba form 4 application for business loan?

With pdfFiller, the editing process is straightforward. Open your sba form 4 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete how to fill us small business administration schedule of collateral form on an Android device?

Complete sba form 4 application for business loan and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your sba form 4 2009-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Form 4 Application For Business Loan is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.